Virginia offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Virginia Energy Efficiency

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Virginia Government

1000 Bank Street

Richmond, Virginia 23219

(804) 786-2211

[email protected]

Monday – Saturday, 9:00 a.m. – 5:00 p.m.

Sunday, 1:00 – 5:00 p.m.

Dominion Energy

3072 Centreville Road

Herndon, VA 20171

(866) 366-4357

Monday – Friday, 8:00 a.m. – 5:00 p.m.

Virginia Department of Energy

Washington Building / 8th Floor

1100 Bank Street Richmond, VA 23219

(804) 692-3200

[email protected]

Monday – Saturday, 9:00 a.m. – 5:00 p.m.

Blacksburg Weather Bureau

1750 Forecast Drive

Blacksburg, VA 24060

(540) 552-0084

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Graduated Property Tax Exemption | First 5 years: 80% Next 5 years: 70% Remaining years: 60% |

Applies to residential property using solar energy |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Virginia Clean Energy

Nuclear Energy

Offshore Wind

Solar Power

Solar for All

Sustainable Transportation

Carbon Emitting Facility Retirement

Clean Energy Advisory Board

Clean Economy Progress

Department of Environmental Quality

1111 East Main Street

Suite 1400

Richmond, VA 23219

Office Hours:

8:30am-4:30pm

Phone:

(804) 698-4000

(800) 592-5482

Mailing Address:

P.O. Box 1105

Richmond, VA 23218

Overview of Solar Energy in Virginia

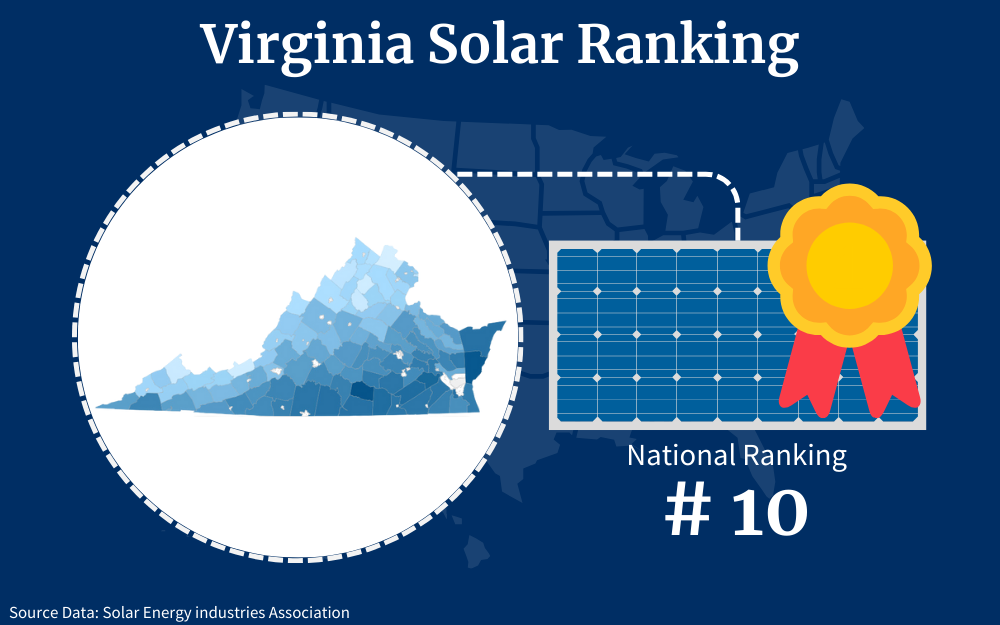

Natural gas was the predominant energy consumer in the state in 2021,9 with renewables rating very low by comparison, but the state actually ranks tenth in solar implementation.

Since the cost of solar panels in Virginia has decreased by more than 40 percent between 2017 and 2022,8 the solar market potential looks bright. Federal and Virginia solar incentives, like solar credits, renewable energy rebates, and net metering program make the cost of solar panels in Virginia affordable and tenable.

This guide provides information on solar panels and review Virginia solar incentives and how to use them so you can make the jump to solar energy if you’ve been on the fence.

Federal Solar Credit Overview

Many states across the US offer federal solar credits, and Virginia is fortunately one of them.

Some solar credits apply when you generate energy through your solar panels. Others go toward your federal tax returns, lessening what you owe Uncle Sam.

More incentives can reduce your electric costs every month. Depending on the tax credits you’re eligible for, you can save or receive hundreds of dollars.

Claiming solar panels renewable energy credits might be as simple as contacting your energy service provider. Many credits might require you to interconnect your new solar panel system to your local utility grid.

You might have to receive an inspection or work with an SREC broker, a third-party trader who can put you in touch with electricity suppliers to sell credits to.

Some solar panel installers will do all the incentive legwork for you, making it even easier and more efficient to get started.

What Solar Credits Are Available in Virginia?

The following Virginia solar incentives are offered by the federal government and state and fall under the jurisdiction of EERE and similar programs.

Residential Property Tax Exemption for Solar in VA

Among Virginia solar incentives is the Residential Property Tax Exemption for Solar which was approved by the state governor in 2022. Beginning on January 1st, 2023, and thereafter, state agricultural and residential solar panel systems are no longer state or locally taxable.

What does this mean?

Installing solar panels often increases a home’s curb appeal. If that happens after you add a solar system to your Virginia home, you won’t receive additional taxes for the increase in value under the Residential Property Tax Exemption.

The Virginia Department of Environmental Quality or a building department nearest you must inspect your home to determine if you’re eligible for this tax incentive. They’ll check the quality of your solar system installation and certify the equipment.

Depending on what the inspection yields, you will receive a tax limit.

Virginia SREC Program

Solar Renewable Energy Credits, or SRECs, are popular statewide programs that work with federal tax credits to deepen savings. Here’s how Virginia’s SREC program works.

As a solar customer, you generate SRECs when you use your solar panels. You get one SREC for every 1 mWh or 1,000 kWh of electricity.

Can you store solar energy? Sure! You can continue accumulating SRECs as you wish, and then sell them.

Selling SRECs is best done with a broker. Sol Systems and SRECTrade are the most popular options, but you can seek smaller brokerages if you want.

Your broker will sell your credits on your behalf on the market. The money you make is yours to do what you like, but you might use it to pay off the cost of your solar panels or begin chipping away at solar loan payments.

SRECs sound great, but they do have drawbacks. Namely, there are limits imposed.

The credit limit is $75, but most homeowners don’t even make that. A better estimate is around $20, maybe $50.

How do you begin claiming and selling SRECs?

Appalachian Power and Dominion Energy customers can contact their energy providers to begin. Outside of those power companies, you first have to connect your solar system to the grid.

Next, choose an SREC broker and register with them. Agree to terms with your SREC broker, such as when they’ll sell your credits and for how much.

Additional Local Utility Rebates and Renewable Energy Programs in Virginia

Although solar power can significantly reduce your energy costs, there are local utility providers that also offer effective ways to help you save on electricity use and expenses.

The following incentives are available for residents in Virginia.

| Provider | Program | Conditions | Contact |

| Appalachian Power (Electric) | Residential Energy Efficiency Programs:

|

Incentives are based on income for weatherization, but all residents can take advantage of rebates from $25-$400 for various appliances | To explore any of the rebate plans and available options, visit the provider website. |

| Dominion Energy | EV Charger Rewards | $40 Yearly reward for enrolling your Level 2 Smart EV charger in the program. | To register for the rewards program, fill out the application on the website. |

Federal Solar Investment Tax Credit

How about a federal solar incentive? Virginia’s Federal Solar Investment Tax Credit, or ITC, is a solar energy government-issued credit that applies to federal income taxes.

The savings begin for the tax year you got the solar panels installed and are valued at a max of 30 percent of the cost of your solar system. An ITC credit limit is around $9,000, which is quite a nice tax break.

It gets even better. The ITC savings will continue for five consecutive years.

However, this solar incentive program will only run in the country until 2035, and its value is slated to decrease. The savings for photovoltaic cells will decrease to 26 percent by 2033, then again in 2034 to 22 percent.

How Do Net Metering and PPA’s Work?

There’s one more state solar panel incentive we didn’t discuss, and that’s net metering.

This nationwide mechanism affects what shows up on your electricity bills. If you generate electricity yourself through solar panels, you can use your electricity stores now, then, or whenever you need to.

Solar panels aren’t effective 100 percent of the time. They simply can’t be, which is one of the problems with solar energy.

After all, they don’t work after dark or in overcast weather. Net metering allows you to tap into grid power during those times when your solar panels aren’t working at full efficiency.

If you have a stretch of sunny days and your solar system generates more than enough power, you don’t have to keep the excess electricity. You can send it to your local power grid and your electricity company will pay you credits that can go toward your electric bill.

Depending on the extent of your solar system and how much electricity you use, you can seriously lessen your electricity bills. You might even eliminate them altogether.

Net metering can be great for your wallet but be aware of possible fees you could incur. For example, if your system exceeds 15 kilowatts, as a Dominion Energy customer, you might have to pay standby charges if you reach peak power.

Larger solar systems up to 25 kW can incur distribution standby and transmission fees from Dominion.

The way to join a net metering program varies by Virginia electricity provider, so let’s discuss.

Applying for Net Metering as an Appalachian Power Customer

If your solar system has a residential capacity of 25 kW (or under), you can join the Appalachian Power net metering program.1

Applying for the program requires completing a Net Metering Application. You’ll need a PowerClerk account to send in your form.3

Appalachian Power will send a net metering informational package that details conditions, the net metering tariff, and the Net Metering Interconnection Notification or NMIN form.

This form is two pages long and broken into several sections. Fill in Sections 1 through 4 before your solar panels are installed. After you get pre-approved, complete the rest of the form and undergo a final round of field approval.

Applying for Net Metering as a Dominion Energy Customer

Dominion Energy customers should follow a slightly different protocol.

Complete the notification form to join the Dominion Energy Net Metering Program.4 You must also attach proof of insurance with your form sent through the mail or by email.

After Dominion receives your application, they’ll send a representative to your home to check your solar system connection. If it’s compatible with their electric distribution system and your application is approved, a representative will sign your form.

You might have to modify your system to improve its compatibility. Once you get your solar panels installed, fill out the fifth section of the notification form.

Send it to Dominion Energy. They will approve the form and authorize you to begin net metering.

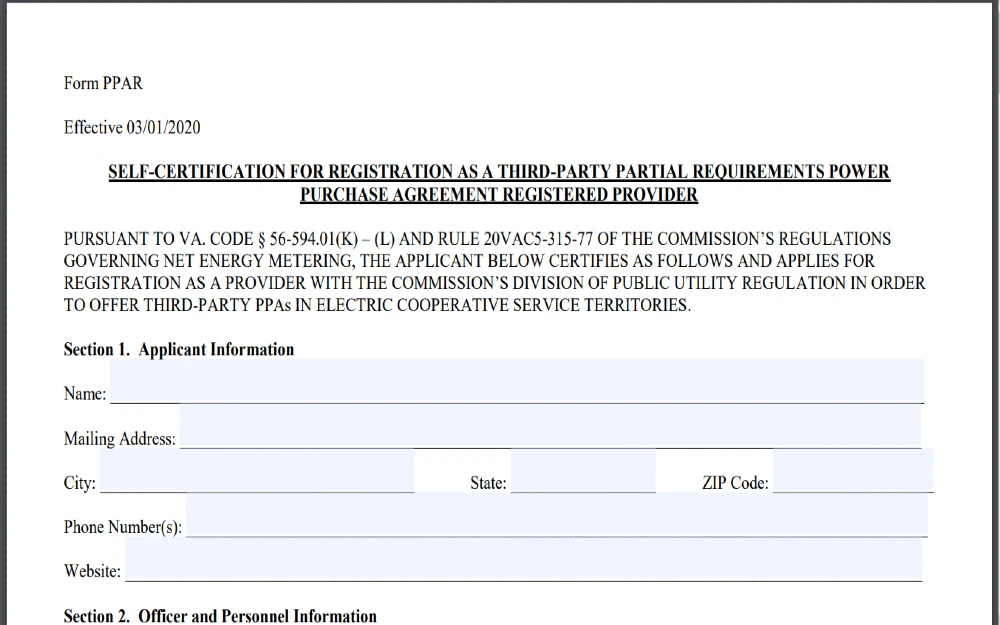

What Is a PPA?

Since the cost of a system is relatively high for some, many people often ask ‘how to get solar panels from government free of charge’.

While there really is no program that gives out free solar panels, you can explore a power purchasing agreement or PPA instead.

A PPA is a solar agreement where a developer installs and operates your solar panels. You will pay far less for a solar system under a PPA than you would without. Sometimes, the PPA even comes free.

A solar PPA varies from a solar loan. If you take out a loan, you own the solar system and receive the tax credit.

You will make a monthly payment determined by your interest rate and the cost of the system. That rate will remain consistent until you pay the loan off.

If you decide on a PPA, you don’t own the solar system; the company giving you the PPA does. They also get the tax credit.

You’ll pay two electricity bills per month, with one calculated according to the kWh you produce.

How To Apply for Solar Credits and Rebates in Virginia

Are you ready to take advantage of solar power, do our planet a favor, and put more cash in your wallet? Here is everything you need to know to get started.

A Glossary of Solar Credit and Rebate Terms

- Subsidized loans: A subsidized loan is an incentive with reduced interest rates. You must repay the loan. Besides the lower interest, a subsidy also has flexible options like payment deferrals, reduced payments, and extended repayments.

- Grants: A solar grant gives you money to use toward your solar system. You only receive a grant if you meet the specific terms.

- Solar sales tax exemption: This exemption lessens sales tax from solar energy equipment, sometimes eliminating the cost altogether. Eligible equipment might include mounting racks, inverters, and solar panels. PV installation and labor costs are also sometimes included under the exemption.

- Property tax exemption: A home with solar power panels might be eligible for a property tax exemption, which reduces increased property taxes after adding solar power.

- Tax exemptions: These are general exemptions that apply on a statewide basis and are usually offered countrywide.

- Utility rebate: Some electric companies offer utility rebates to make switching to solar power a more cost-effective choice. The rebates vary based on per-kWh, cash payments, and other incentives.

- State tax credit: State tax credits are offered in addition to federal credits to compound your savings for solar panels in Virginia.

- Federal solar tax credit: These nationwide incentives are referred to as ITCs. All federal taxpayers with a solar system are eligible.

Filing for the incentives is as simple as contacting your electric provider and completing the solar tax credit forms Virginia provides.

Enjoying federal solar tax benefits requires completing IRS Form 5695.6 This form includes two parts.

Part 1, Residential Clean Energy Credit, asks for various costs, including qualified solar electric property costs and qualified geothermal heat pump property costs. Add the costs and multiply that number by 30 percent.

This section also requests qualified fuel cell property costs, which you should multiply by 30 percent.

Part 2 is the Energy Efficient Home Improvement Credit, a questionnaire deducing your eligibility for the credit.

Solar Panel Installation Costs

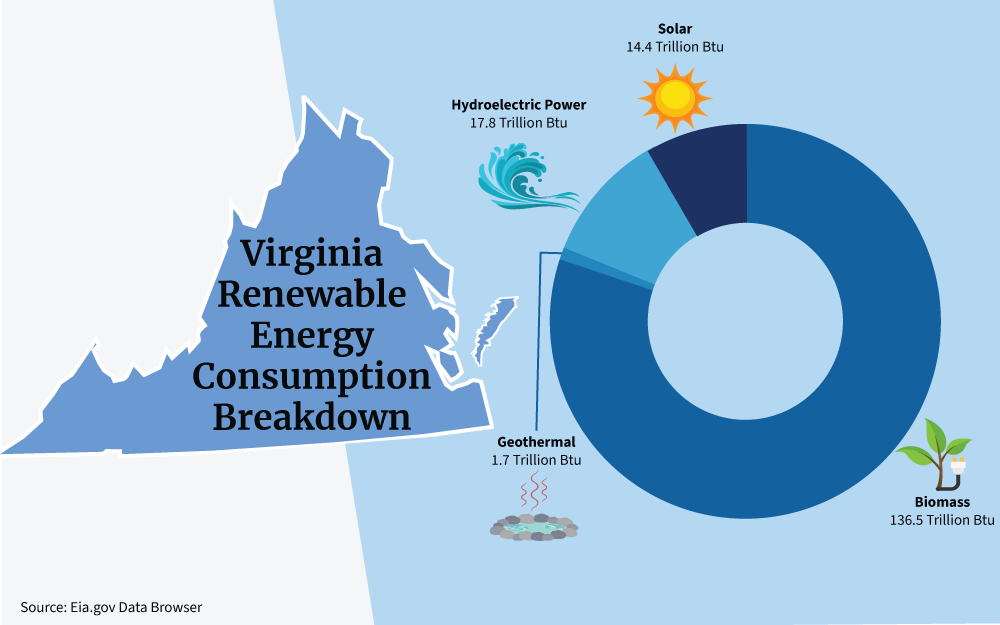

Solar is currently the third largest source of renewable energy in Virginia, behind hydropower and biomass. This is likely to increase as the state government continues to encourage residents to switch to solar.

The above incentives would be enough to make anybody consider solar. If you’re ready to make the switch, you’ll wonder what it will cost you.

Before answering that, we should ask another question: what is a solar panel? Also referred to as a PV panel, a solar panel takes sun energy called photons and converts it to light or electricity.

What are solar panels for? Solar panels are installed on your home’s roof to maximize sun absorption. They work without your intervention when the sun shines.

What are solar panels made of? They include crystalline silicon glass, plastic polymers, copper, silicon, aluminum, and other metals.

Solar panel material are part of what contributes to the overall cost of the system, which is between $17,400 and $23,000 across the US.2

It’s even pricier in Virginia! Solar panel components are valued from $17,950 on the lower side to $46,670,5 with an average cost of around $30,000.

Remember, solar prices have dropped in Virginia, so these are considered low prices.

So, why the price hike?

Cost fluctuations come down to all sorts of factors. Some neighborhoods and states quote higher prices than others, usually with prices in line with the cost of living.

The varying sizes of solar panel systems also play a role.

You can be left stunned by solar quotes, but this is where tax credits come in.

Solar Calculator: How Much Can You Save?

Arguably, the biggest question you’ll have if considering solar is how much money can you save.

Here is a handy calculator for crunching the numbers. Let’s break down the factors in the calculator one by one.

Determining How Many Solar Panels You Need

The average number of solar panels USA homes require varies between 15 and 34. The number fluctuates so much due to these factors:

- Solar panel size (panels can be smaller or larger depending on whether they’re 60-cell or 72-cell panels)

- Your home’s square footage

- Whether you want to use solar panels to offset some of your electricity or the entire electrical load

Do you want a more mathematical way to go about it?

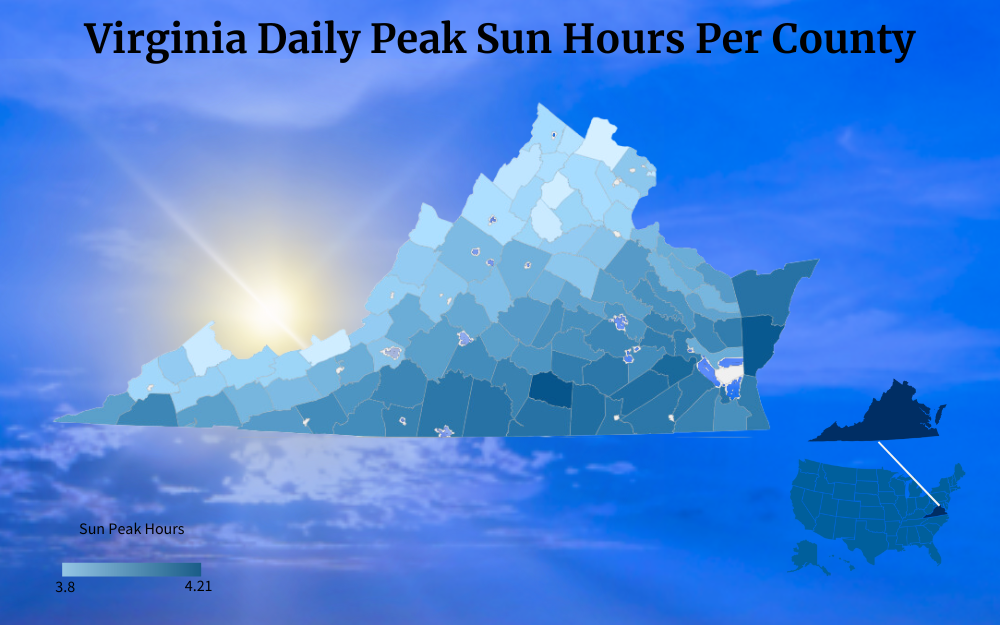

How about this? Multiply your home’s hourly energy by peak sunlight hours, then divide it by the average wattage of a solar panel.

First, calculate using 150 watts, then 370 watts to get a range.

Calculating the Required Solar Energy

Going hand-in-hand with deciding how many solar panels you need is determining your required rate of solar energy. Most US homes use 886 kWh of energy a month, which is 10,632 kWh annually.10

You might use that much power in your home, or perhaps it’s less. Calculate the number by dividing the average hourly wattage by your neighborhood’s number of peak sunlight hours per day.

Estimating Your Solar Savings

Once you know how much solar power you need and what you’ll spend, you can compare that cost against your electricity bills now. The savings should make themselves readily apparent.

How To Find VA Solar Panels

You need a reliable company to build your home’s solar system due to the complexity and pricing of solar panels. The following tips will help you hire the right team for the job.

Ask for the Company’s Credentials

Quality solar companies in Virginia will have certifications, licensing, and other credentials, such as a North American Board and Certified Energy Practitioners or NABCEP certificate.

Licenses prove the solar company’s expertise and provide peace of mind you’ve selected a company that will correctly install your solar system. If a company doesn’t have certifications, keep looking, as you should be wary about working together.

Read Reviews

You shouldn’t have to go far to find reviews for a solar company. A reputable company will have testimonials on its website but don’t only rely on those.

Check the company’s Google Business reviews, social media reviews, and sites like Yelp or Angi.

Companies will cherry-pick only the best testimonials for their websites, but sites not affiliated with them paint a more honest picture of the company.

You shouldn’t expect an absence of negative reviews, as that’s unrealistic. Instead, a good Virginia solar company should have more positive reviews than negative ones.

Discuss an Installation Timeline

Solar panel installation times vary. The general timeline is about six hours to three days, but depending on the complexity of your system, it could take longer.

A quality solar company will provide a time estimate you can plan your schedule around.

Ask Upfront About Fees

Fees will inevitably arise, but the question becomes, how much will you pay for them? As you narrow your options to the final two to three solar companies, request a walkthrough of your property.

During the walkthrough, ask for a quote based on the solar company’s survey. Cheaper isn’t always better, especially when it comes to solar panels.

A company that cuts corners might produce what looks like a passable outcome now but will not hold up over time.

Discuss Their Breadth of Services

A full-service installer might provide solar battery monitoring, tree removal, roof repair, and energy monitoring.

If the solar company doesn’t take care of these services, that doesn’t mean you can skip them. You’ll have to hire other parties to do these jobs instead.

Often, a solar company that doesn’t provide full services will not proceed with the installation until these other jobs are taken care of.

You can spend a lot more money and time if a solar company isn’t a full-service installer.

Is It Worth It To Go Solar in Virginia?

Going solar in Virginia is worthwhile for many reasons. Virginia wants to go carbon-free by 2045,7 and you can help the state achieve that goal.

Using solar energy means embracing a renewable energy source instead of fossil fuels that contribute to climate change. You’re creating a more hospitable planet for future generations, including your grandchildren.

You can also benefit much more immediately. Solar panels will reduce your energy bill spending, allowing you to recoup hundreds to thousands of dollars over the lifetime of the panels.

Virginia is a state with plenty of solar potential, and there’s not a better time than now to consider solar panels for your home. If you take advantage of Virginia solar incentives and rebates, you can further your savings, reducing your tax and electricity bill spending.

Frequently Asked Questions About Virginia Solar Incentives

How Long Do Solar Panels Last?

The life of solar panels can last upwards of 20 to 25 years, but this still depends on the quality and maintenance of your system over time.

What Do I Do When My Solar Panels Are No Longer Functioning?

If you’re wondering how to dispose of solar panels when yours exceed their value, glass recycling facilities will often take the panels and recycle them and their metal frames.

What Is the Payback Period for Solar Panels in Virginia?

A payback period is how long it takes for solar panels to begin paying off, such as by increasing your home’s property value and/or reducing your electricity bills. The average US solar payback period is six to 10 years, while it’s 10 to 13 years in Virginia.

References

1Appalachian Power. (2020, June 1). Virginia Net Metering FAQs. Appalachian Power. Retrieved September 15, 2023, from <https://www.appalachianpower.com/lib/docs/business/builders/VirginiaNetMeteringFAQsTY.pdf>

2Carthan, A. (2023, July 26). How Much Do Solar Panels Cost and Are They Worth It? This Old House. Retrieved September 15, 2023, from <https://www.thisoldhouse.com/solar-alternative-energy/reviews/solar-panel-cost>

3Clean Power Research. (2023). PowerClerk Log In. PowerClerk. Retrieved September 15, 2023, from <https://aep.powerclerk.com/MvcAccount/Login>

4Dominion Energy. (2020, March 1). Form NMIN. Dominion Energy. Retrieved September 15, 2023, from <https://sitetracker-dominionenergy.my.salesforce-sites.com/NMIN/>

5Foushee, F. (2023, August 29). Virginia Solar Incentives: Tax Credits & Rebates Guide 2023. SaveOnEnergy.com. Retrieved September 15, 2023, from <https://www.saveonenergy.com/solar-energy/virginia/>

6Internal Revenue Service. (2022). Residential Energy Credits. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

7Reuters. (2020, March 7). Virginia passes bill to achieve 100% carbon-free power by 2045. Reuters. Retrieved September 15, 2023, from <https://www.reuters.com/article/us-usa-virginia-renewables/virginia-passes-bill-to-achieve-100-carbon-free-power-by-2045-idUSKBN20T2OF>

8Solar Energy Industries Association. (2023). Virginia Solar. SEIA. Retrieved September 15, 2023, from <https://www.seia.org/state-solar-policy/virginia-solar>

9U.S. Energy Information Administration. (2023). Virginia State Profile and Energy Estimates. EIA. Retrieved September 15, 2023, from <https://www.eia.gov/state/?sid=VA>

10Wakefield, F., & Addison, T. (2023, September 11). How Many Solar Panels Do I Need? MarketWatch. Retrieved September 15, 2023, from <https://www.marketwatch.com/guides/home-improvement/how-many-solar-panels-do-i-need/>

11Solar photovoltaic array at Cooper Vineyards in Louisa, VA Photo by USDA Photo by Lance Cheung / Attribution 2.0 Generic (CC BY 2.0) . Cropped, Resized and Changed Format. From Flickr <https://www.flickr.com/photos/usdagov/6235037564>

12Screenshot of Form PPAR. Commonwealth of Virginia State Corporation Commission. Retrieved from <https://www.scc.virginia.gov/getattachment/778c31a4-99e6-4c91-8fb7-e24e3084e3e7/ppar.pdf>